Fixed vs. Adjustable Interest Rates

One of the first things you need to when choosing a mortgage is how your interest rate is dealt with. You can lock the

rate, make it flexible or do a combination of both. For instance, if you get a 30-year mortgage with a 5/1 adjustable-rate

mortgage, your interest rate will lock for five years, then adjust annually for the remaining 25 years.

Fixed-Rate Mortgages

Pros: The financing cost remains the equivalent for the whole time it takes you to take care of the credit, so the size of your regularly scheduled installment remains the equivalent, which makes it simpler to design your spending plan.

Cons: Contrasted with a home loan with a customizable financing cost, a fixed loan fee may be higher—from the outset.

Adjustable-Rate Mortgages (ARMs)

Pros: Offers a lower interest rate and monthly payment for the first few years.

Cons: The initial low-interest rate is surely appealing but in exchange for that upfront lower rate, there is the risk of higher interest rates down the road. Many people discover this kind of home loan engaging because they can qualify for a more costly home. But, the majority of the homeowners learned in the economic downturn, when your rate increases or you lose your job, the payment can quickly become too much for you to afford.

Bottom line: ARMs are one of the most exceedingly terrible kinds of mortgages out there. Keep a greater amount of your cash and go with a fixed-rate instead.

Types Of Mortgage Terms

This refers to the length of your loan and is an agreement with your lender on the maximum amount of time (years) that

you can pay the loan in full. Years range from 15, 30 and up to 50 years.

15-Year Mortgages

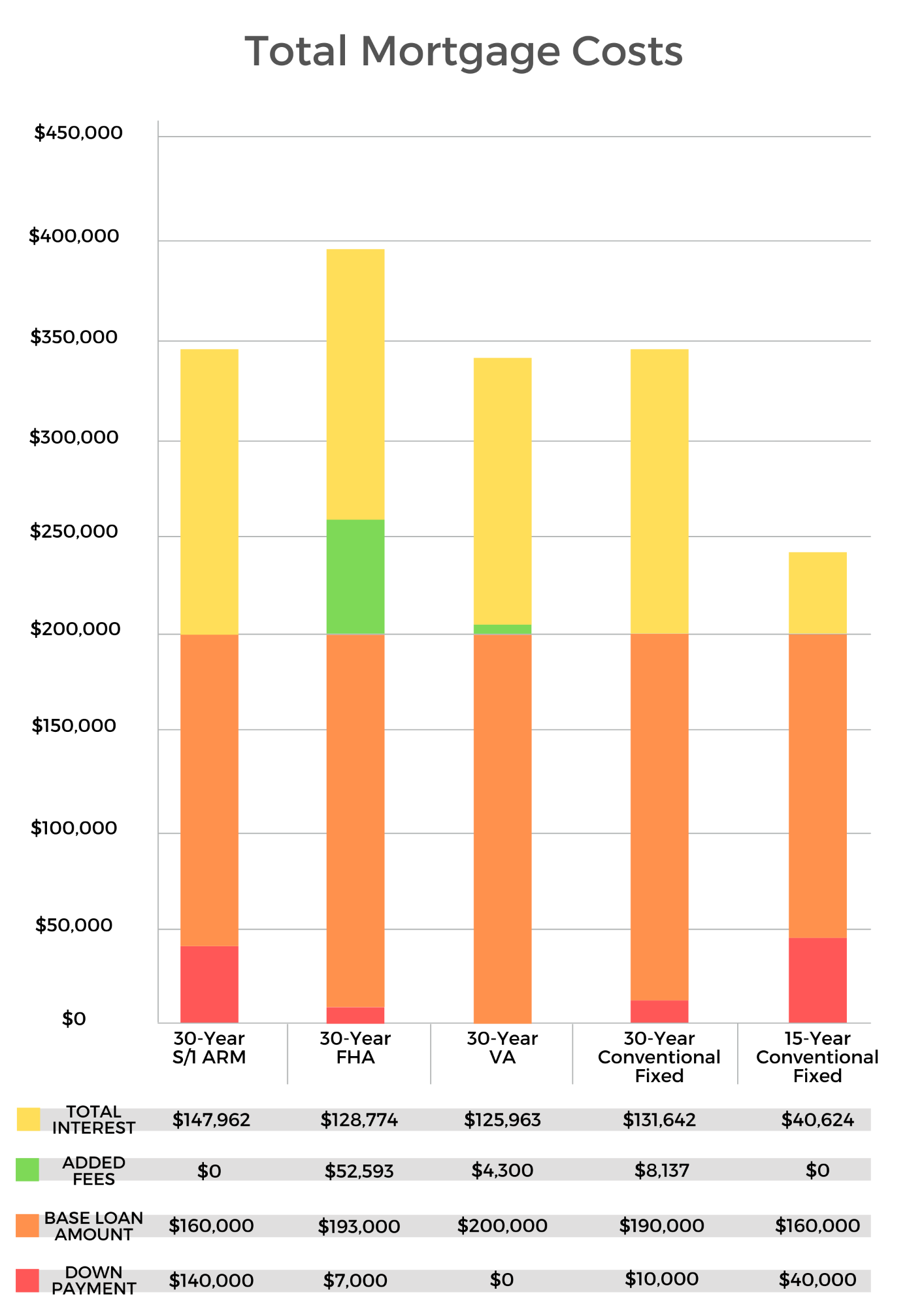

Pros: This mortgage term has a lower interest rate and will cost you less interest in total compared to longer-term loans. This allows you to pay for the house faster.

Cons: This comes with a higher monthly payment compared to a 30-year or longer term.

30-Year Mortgages

Pros: This term lets you have lower monthly payments compared to a 15-year term.

Cons: In contrast to lower monthly payments, this term has a high-interest rate, which means you will be in debt longer and pay more interest than you thought.

Bottom line: Choosing a 30-year contract takes care of the possibility that you should put together major monetary choices with respect to the amount they'll cost you each month. That is misguided reasoning. On the off chance that you need to excel with your cash, you must think about the absolute expense. A 30-year contract implies 15 additional long stretches of obligation and a huge number of dollars more in revenue. Not this time-go for the 15-year term, pay less in interest and add additional installments to take care of it significantly quicker.

Conventional vs. Unconventional Mortgages

A conventional loan is an agreement between you and the lender and follows specifics underwriting guidelines.

Meanwhile, the unconventional loan includes Government-issued programs like FHA, VA, USDA, and they set their

own underwriting guidelines.

Conventional Loans

Pros: Your total cost, including interest and fees, is lower than an unconventional loan.

Cons: Lenders have the liberty to charge a higher interest rate or require a higher downpayment because Conventional loans are not backed up by the Government. If your downpayment is less than 20% of the home's value, you are required to pay private mortgage insurance (PMI). PMI secures the lender if you default on your loan.

Subprime Mortgages

Pros: Subprime Mortgages are intended to help individuals who experience difficulties—like separation, joblessness, and health-related crises. Lenders will give you money regardless if you have a bad credit score and no money.

Cons: These lenders know the risk of lending money to people who has no stable flow of income, so they have set high standards of agreements which include high financing cost and prepayment penalties.

FHA Loans

Pros: With as little as 3.5% downpayment, you can get a mortgage.

Cons: In contrast to the low downpayment, you are required to pay a Mortgage Insurance Premium (MIP), a fee similar to PMI, but you have to pay for the duration of the loan. If you don't want to pay the MIP, the only way it can be removed is to have more than 10% of the downpayment, but still, you have to pay for it for 11 years. Here's an example, MIP can attach $100 a month per $100,000 borrowed. So, if you borrowed $200,000, they can add an extra $200 on top of your regular mortgage!

VA Loans

Pros: VA or Veterans Affairs loan is for military veterans, who can buy a home with no required downpayment or mortgage insurance.

Cons: The only downside of purchasing a home with zero down payments is when things change in the housing market, you could wind up owing more than the market value of your home. This loan comes with a funding fee and can range anywhere from 1.25% to 3.3% of your loan, considering your military status, down payment amount, and if it's your first time financing a home with a VA loan. It ranges between $2500 to $6,000 for a $200,000 loan.

USDA/RHS Loans

Pros: This loan program is for the people who live in rural areas and has financial needs from low to medium income offered by the United States Department of Agriculture (USDA) and is managed by the Rural Housing Service (RHS). By availing of this loan, you can purchase a home with no down payment at below-market interest rates.

Cons: You don't have the option to refinance your loan to improve your interest rates and has horrible penalties.

Bottom line: Unconventional loans are surely helpful especially for people who don't have the means to buy a house but have higher fees and restrictions. It's better to go with a conventional loan and you can pay a lower total cost.

Conforming vs. Non-Conforming Mortgages

Your mortgage can be determined by a conforming and non-conforming loan and that depends on how much money your

lender will give you. A conforming loan fulfills and meets the standard underwriting guidelines.

An example would be conventional and non-conventional loans. Remember, conventional loans have standard underwriting

guidelines and these are provided by Government-sponsored like Fannie Mae or Freddie Mac companies while

non-conventional loans like FHA and VA set their underwriting guidelines.

These companies buy loans from your lender so the lender can fund more mortgages. But they’ll

only buy loans that are within the size limits established by their guidelines. If your loan size exceeds their limits and

doesn’t conform to their guidelines, it’s considered a non-conforming loan.

Conforming Loans

Pros: Compared to a non-conforming loan, you will pay a lower interest rate. Recent 15-year rates are averaging under 4% on conforming and over 4% on jumbo loans.

Cons: FHA and VA have additional fees and high financing costs and your smartest option is a Fannie Mae conforming loan.

Jumbo Loans (Non-Conforming)

Pros: This loan exceeds the loan amount limit set by Fannie Mae and Freddie Mac, which implies you can get a more costly home.

Cons: This loan requires excellent credit standing and larger down payments, and has higher interest rates.

Bottom line: A conforming Fannie Mae loan will be your least expensive alternative here, in the event that you put 20% down to keep away from PMI.